PIP launches no-coding button to simplify blockchain payments

Web3 payment provider PIP has launched an initiative that aims to help the blockchain content creators accelerate their small business through a non-invasive payment solution.

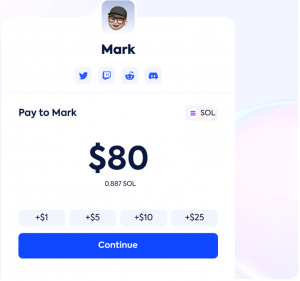

Called ‘The PIP Button,’ the solution enables users to pay for creative content that they love much faster and more affordable by integrating major blockchain systems.

Built on Solana, PIP connects scalable crypto-protocols with common social platforms like Twitter and Facebook. Creators and service owners can seamlessly transact value through integrating the PIP button into their website and unlock an extra revenue stream. The process can be also done without a single party’s permission or a high intermediary fee.

Setting up the PIP button requires setting up a wallet through Phantom Wallet or Slope Wallet. Currently supporting Solana tokens and transactions (including SOL, USDC, PIP, SERUM, RAY, KIN, ORCA, etc.), the team plans to roll out support for additional major blockchains over the coming months.

The PIP button is geared towards entrepreneurs working in art, music, fashion and film who are serious about incorporating blockchain into their business model, whether they’ve just launched their project or have several successful drops under their belt.

More specifically, the button enables content consumers to reward their favorite creators through blockchain technology. Although creators can monetize their content via social networks, these legacy payment systems demand complex knowledge and coding experience to attach. In comparison, this simple button made with just a few clicks will provide the gateway to the payment infrastructure without any obstacles.

“Integrating the PIP button will be as easy as making a new WordPress post or posting a new image/video to Instagram. The button works on any platform based on HTML, React, Javascript, and third-party services like WordPress, Wix, Squarespace, etc.,” the company says.

The PIP button enables creators migrate their audience away from legacy platforms and onto their own apps to adopt new monetization strategies. For the user, it is possible to pay for unique content or goods by clicking the button.

Allowing creators to integrate additional payment methods without coding knowledge can encourage widespread adoption of cryptocurrencies by providing direct, secure, and fast transactions. A payment tool designed specifically for the blockchain economy can serve as a monetization tool as the PIP button’s open system removes the need for signups and accounts, creating a frictionless solution

PIP is the developer of the PIP Button, a startup that acts as a Web 3.0 bridge connecting the blockchain world to the web 2.0 platforms. More importantly, Pip offers a neutral platform that allows interoperability among social platforms like Twitter, Reddit, Discord and Twitch when it comes to crypto activities.